Is your state road system broke? Then hit up the Prius drivers!

Last week, the Missouri Department of Transportation announced they were considering a proposal to raise the plate registration costs on fuel efficient vehicles. To many people, this move might seem, frankly, a little insane, and more than a little regressive. If we subscribe to the basic economic principle that societies should leverage taxes and fees to make things we want to see less of more expensive for people to buy, and things we want to see more of less expensive, what’s the logic behind taxing the odd Tesla or Prius or even just a fuel-efficient Toyota?

If what we want are safe roads that we can afford to repair, why on earth would we incentivize drivers to buy gas guzzling vehicles—which skew towards the heaviest vehicles most capable of causing extensive road damage—rather than light, fuel efficient vehicles that might help keep that pavement intact for longer?

The answer, of course, is because Missouri doesn’t really want to maintain their roads—or at least, they might say they do, but their actions and policies speak otherwise. What Missouri wants is what most states in America want: endless “growth” in the form of endless road construction.

For context for those who live outside the state, Missouri has the 7th largest number of highway miles in the nation and the 46th lowest revenue per mile for maintenance, mostly because our largest source of funding depends on a bottom-of-the-barrel gas tax of just 17 cents per gallon. That’s an amount, by the way, that hasn’t been increased since 1996. Again, context: I am in my thirties now. This is what I was reading in 1996. It was a simpler time.

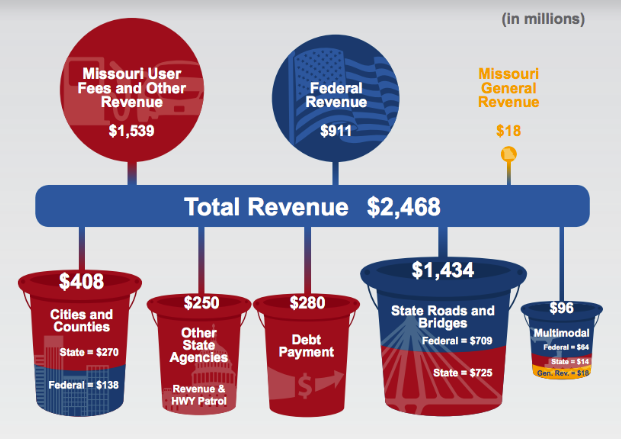

Last year, Missouri’s DOT released a “Citizen’s Guide to Transportation Funding” to explain all of this to people like you and me. Here’s a choice page from the guide:

In the bottom panel of their handy graphic, The Missouri Department of Transportation, to their credit, dispenses with the myth that our drivers pay for our roads because they’re funded exclusively by our gas taxes—they aren’t, by a longshot—and they almost realize that even with the supplemental revenue of taxes on car sales, aviation fuel, and yes, even those magical registration fees, this funding structure makes no financial sense for the development pattern our state’s chosen. Then MoDOT backs off that epiphany and moves onto a page that says a lot more about those other sources of revenue that are, y’know, also not meeting our state’s basic needs.

But when you lump all that money together and start spending it, things get a little harder to defend.

Shiny pretty graphic design aside, the above illustration should lead a savvy Strong Towns reader to ask some important questions:

- How much of the giant “Cities and Counties” bucket and the even bigger “State Roads and Bridges” bucket are going toward maintaining what we have versus building more and more stuff?

- Why is the multimodal transport bucket the relative size of a takeout cup, especially since we know those modes could save us a lot of money?

- What on earth is up with these incorrectly scaled buckets?

- Why isn’t there a circle-blob labeled “debt” above the line, too? Where did our debt come from, and why do we need to prop up our road system with borrowed dollars? Why isn’t the land our roads are built on producing the wealth we need to keep them in working order?

Look: I know not everyone is a Strong Towns advocate. You can’t blame the average person for looking at reports like these and thinking: Well, we need to get the money from somewhere. Better tax those Richie Rich electric car nuts.

“Pause for a minute and look beyond that knee-jerk fear, and you’ll find that the solutions our DOTs are offering us might make life even worse for that poor driver, and for all of us.”

It’s a radical thing, to re-imagine the world you live in, especially if that world is made of highly permanent concrete highway ramps that you can sail onto without ever paying a toll, just like you’ve done your entire life. It might be even more difficult to reimagine this world for a member of the working poor who has no choice, it seems, but to drive alone every day in their busted SUV that was the only car they could get, just to get themselves between their three jobs that barely allow them to make make ends meet. From that perspective, of course you’d want the snob with the fancy limited edition Tesla to pay more at the DMV. Low income drivers need those roads to survive. And if they have to pony up even a penny more, they won’t be able to make rent.

But pause for a minute, and look beyond that knee-jerk fear, and you’ll find that the solutions our DOTs are offering us might make life even worse for that poor driver, and for all of us. The hefty registration fee on the Nissan Leaf might patch a budget pothole for a day, but it won’t address the yawning chasm as the rest of our overbuilt road network continues to crumble—and meanwhile, we just incentivized more heavy, gas-guzzling cars to get on the road and accelerate the problem even faster. Even raising Missouri’s bargain-basement gas tax might not do what we hope it will: if the last seventy years of road-building can serve as any example, it’ll just contribute to our collective misunderstanding that because we’re paying more at the pump, of course we can afford to overbuild our roads forever (nevermind that gas taxes have never, and will never, pay for infinite, senseless growth.)

You might be feeling a little hopeless now. Take a breath. Because past that fear, we have something amazing: Options.

We could keep the gas taxes in our cities, where the land tax per acre actually pays for most of the limited asphalt we lay down. But when we look to fund a highway, why not consider road tolls over taxes, especially on premium fast lanes, which would establish a common-sense feedback loop that would encourage people to drive less and make sure the long-road truckers who damage our roads most are paying more of the bill? And in the city, why not look into a tax on vehicles miles travelled rather than on gasoline?

In both instances, long-travelling poor drivers would have to pay more, but it wouldn’t be any more brutal on them than our current system, which does nothing to disincentivize the constant road construction and extended development patterns that put that poor drivers’ three jobs miles and miles apart from one another in the first place. And while we’re at it, we could take small, incremental steps to make our development pattern more dense and human-scaled, so we wouldn’t have to pour so much money and debt into propping up a road system that simply doesn’t, and will never, create enough wealth to sustain itself, and makes a lot of us pretty miserable in the process.

We can start doing these things from the bottom up, today. And furthermore, that’s the only way we’ll do it: by convincing our neighbors to take a leap, re-imagine the world with us, and help us do everything we can to build our communities a better way.

In tomorrow's article, I’m going to give Missourians, and residents of states tackling similar failures of imagination (hint: that’s probably most of you), one specific way to do just that. I hope you’ll join me.

Congressman Jake Auchincloss: "We don't need a gas tax holiday. We need a gas tax reset: an overhaul of how we approach transportation funding.”