The Surprising Relationship Between Retail Tax and Property Tax

Look to the center of any town or city and you will find value. In fact, together with our colleagues at the geoanalytics firm, Urban3, we’ve definitively proven that traditional, walkable downtowns are far more financially productive per acre than the suburban development on the fringe of any city. (Check out these articles to get up to speed.)

But one pushback we often get when we publish this data is, “What about sales tax?” And these commenters have a point: What about the, surely, vast amounts of sales tax that auto-oriented businesses in suburban areas of town contribute to our communities? A Walmart may not pay much property tax per acre compared with a block of small downtown shops, but its sale tax contributions must be enormous compared to these local stores, right? And that probably outweighs the difference in property tax, so really, Strong Towns and Urban3 should stop being so obsessed with property tax value per acre as measure of the worth of a development… This is how the arguments typically play out.

But today, I’d like to put those arguments to rest using, once again, data collected and visualized by Urban3.

Property Tax vs. Sales Tax Revenue

Let’s start with a basic example: Durango. It’s a small community (population: 18,500) in rural Colorado with the standard development pattern we see in every city, big and small: a historic, walkable, mixed-use downtown in the center and suburban, auto-oriented development on the edges.

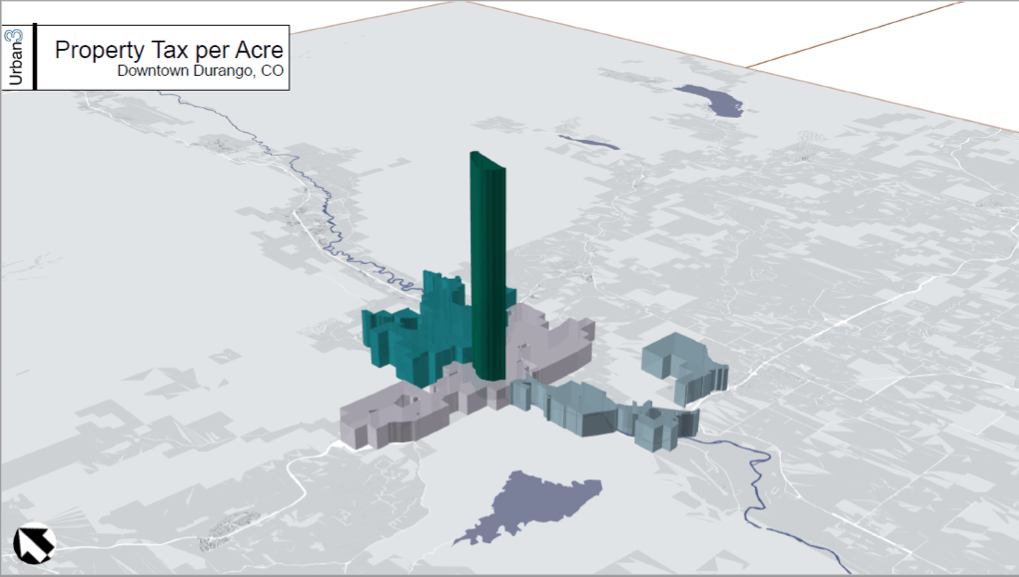

Here’s what property tax values per acre look like in Durango:

Remember: We use tax value per acre rather than tax value per business in order to determine the potency of a particular development. Think of it like measuring miles per gallon instead of miles per tank. Tanks vary in size, but a gallon is a gallon across the board.

This is the standard pattern we see everywhere; the compact, walkable city center (that big green spike in the middle) far out performs any other development in terms of property tax per acre.

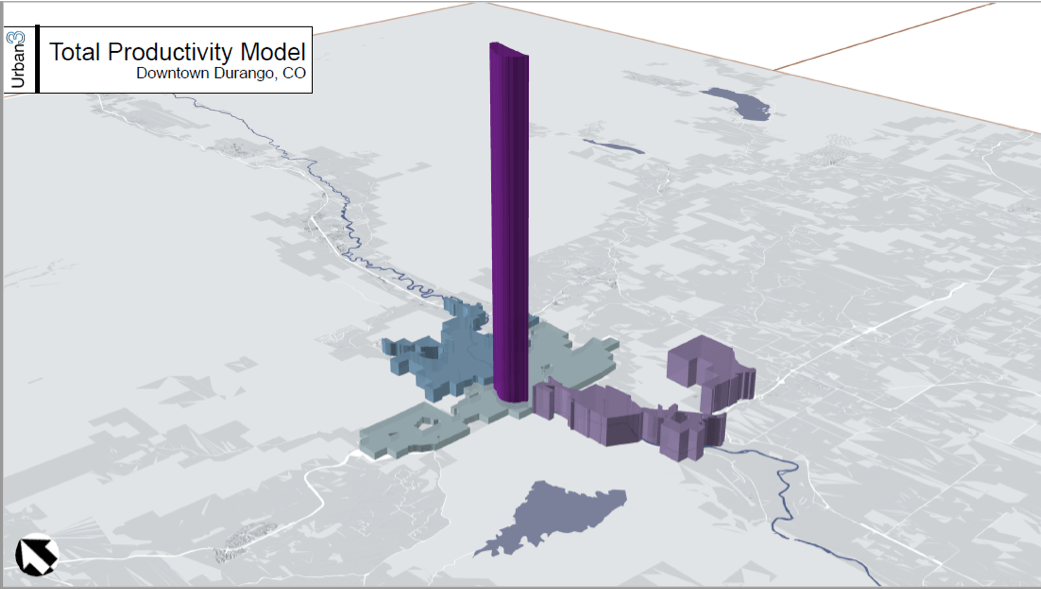

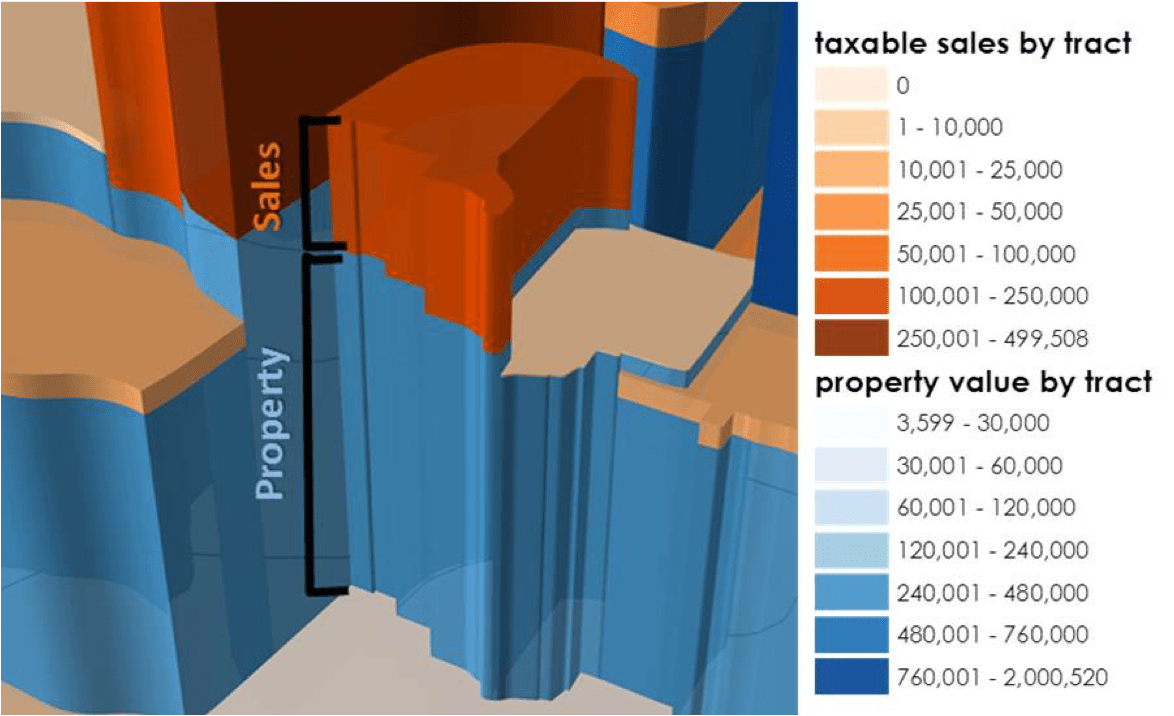

Now let's look at the sales/retail tax per acre:

Surprised? The images look virtually identical. It turns out that these downtown developments are producing the same concentrated value in retail taxes as they are in property taxes.

What's more, when we put both of these tax values together, the impact is staggering:

Meld all the value surrounding the downtown into one and you wouldn't even come close to producing the same amount of property and retail tax value per acre that this small historic downtown generates.

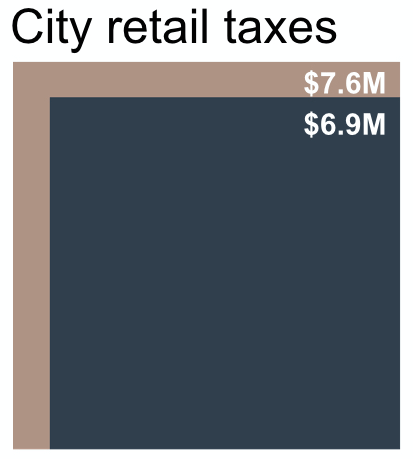

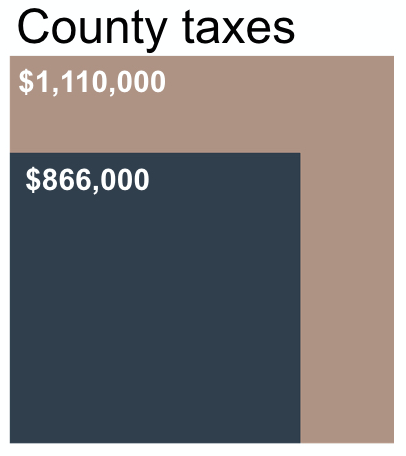

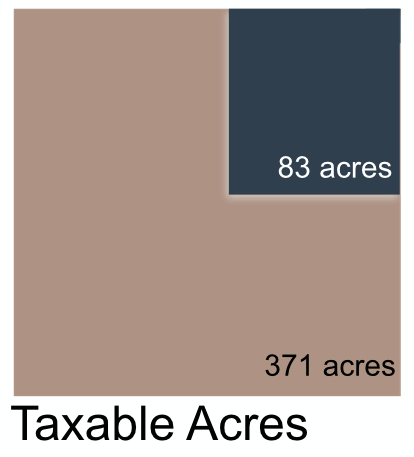

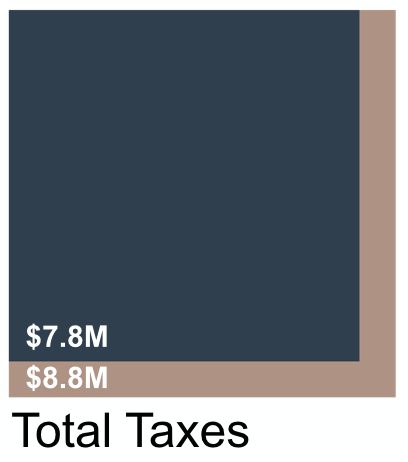

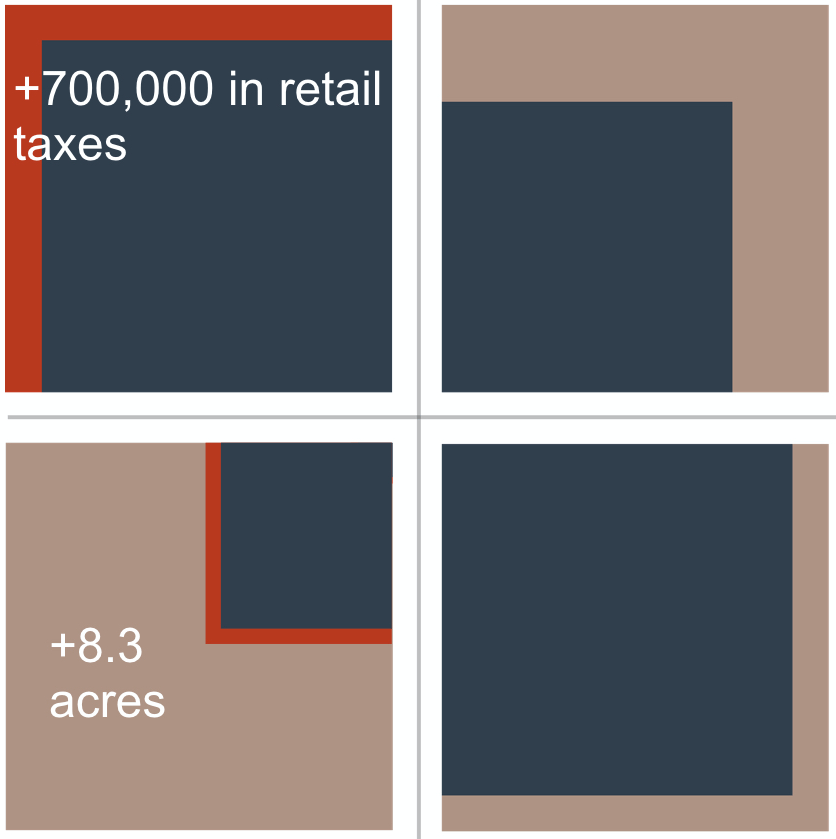

Let's look at this another way. The images below show retail tax and county (property) tax value for downtown Durango in dark blue, compared with tax value for the rest of the more spread out, auto-oriented town in tan.

So downtown Durango occupies just 22% of the land in the city, but its retail and property taxes are producing an amount that is nearly equivalent to the amount of tax value produced by the entire rest of the city!

By adding just a few more acres of downtown development, Durango could make as much in retail taxes in its city center as it makes in the rest of the whole town:

Think about that for a minute. If this town just filled a few more blocks with mixed-use, walkable development, it would make the same amount in taxes as the whole city is currently making. And this is a small community; we're talking about adding a few dozen buildings that are two or three stories tall, not adding blocks full of 20-story condominiums. You can explore more tax data from Durango here.

The Mall Factor

So the pattern seems pretty apparent: Sales tax value per acre fairly closely mirrors property tax value per acre, and when you combine the two, the value of downtown development over suburban-style development becomes crystal clear. But what about cities where there is a significant sales tax generated outside the downtown? For instance, many towns, especially smaller communities, have a big suburban mall that fills their sales tax coffers.

Here's a city where we can see this in action. Peoria, Illinois has a large shopping mall on the edge of town called Northwoods. Here's the sales tax value per acre in Peoria:

The mall's sales taxes per acre look right on par with downtown Peoria. So why isn't the mall a meaningful investment for the community? Well, here's property tax value per acre:

Suddenly, the mall melts back into the fabric of every suburban-style building around it. Its property tax contributions per acre are negligible compared with downtown Peoria's.

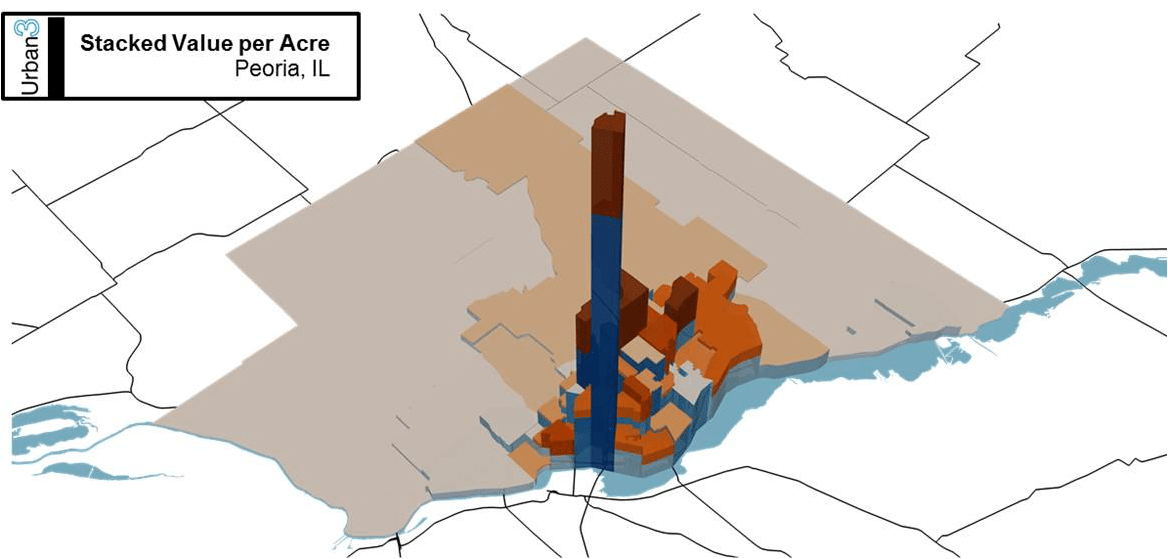

Now let's see the combined sales and property tax values:

When we add it all together, the downtown is still the clear winner — even with that mall producing a solid chunk of the community's sales taxes.

3 Key Lessons

I want to wrap up this discussion on tax values by pointing out a few key insights regarding the traditional vs. suburban styles of development that we've contrasted today:

1. We've neglected our downtowns for decades and they’re still dominating in tax value. What the above illustrations show is that our downtown cores — most of which are full of buildings more than a century old — are, today, producing exponentially more value than the far newer buildings on the fringes of our communities. In the typical town or city, downtown has been utterly neglected or even outright abandoned for the last several decades, but that hasn't decreased its value very much. The way city centers are designed — with compact multistory buildings and streets built for people rather than cars — is what gives it that value. Meanwhile, newer suburban buildings like big box stores, fast food restaurants and strip malls are built for cars instead of people, depreciate rapidly and are unable to adapt to new uses. Thus, their low tax value.

2. Sales tax is volatile and convoluted; we shouldn't rely on it. This isn't illustrated in the graphics above, but it's a vital point to make when talking about sales tax. Even in the situations where a city like Des Moines is getting a nice municipal bump from sales tax revenue, it's not a reliable source to depend on. Retail sales can vary wildly based on the economic climate, tourism trends and other ebbs and flows of commerce — and those variations directly impact sales tax revenue. On the other hand, property tax is a much more stable and predictable source of revenue for a community. Sales tax is often also a more convoluted resource to obtain. Many municipalities don't directly receive all their sales tax revenue from the businesses within their city limits, making it an even less worthwhile source to rely on for local funding. In contrast, property taxes pretty much always go right to the municipalities where the property resides.

3. Sales tax isn't as important as most towns think it is. Take a look at the graphic below showing locally produced budget sources for all 50 states.

The vast majority of American states get no more than 20% of their local revenue from sales tax, and most get around 40% or more from property tax. It's important to keep this in mind when weighing the significance of sale taxes generated by suburban developments in your city. They might provide your municipal budget with a nice chunk of change, but in the big picture, that value doesn't matter nearly as much as property tax value and it's not something your community can reliably count on.

In closing, when your community is considering where to invest its resources, choose the neighborhood that's going to give the most back — in the form of property tax and sales tax. We can keep repeating the mistakes of the suburban development pattern and watch our towns deteriorate in front of us, or we can employ the traditional development pattern that has been successfully used for centuries to create financially strong communities across America.

A huge thanks to Urban3 — especially Josh McCarty — for these graphics and ideas. Durango graphics slightly updated 2/6/18 to reflect final draft data.

Many of the problems in our cities come down to a shortage in the budget—but the solution to this problem is staring us in the face.