Targeted Downtown Incentives that Work

This week's featured member post comes to us from Mike Williams in Fargo, ND. His blog is RenewND.

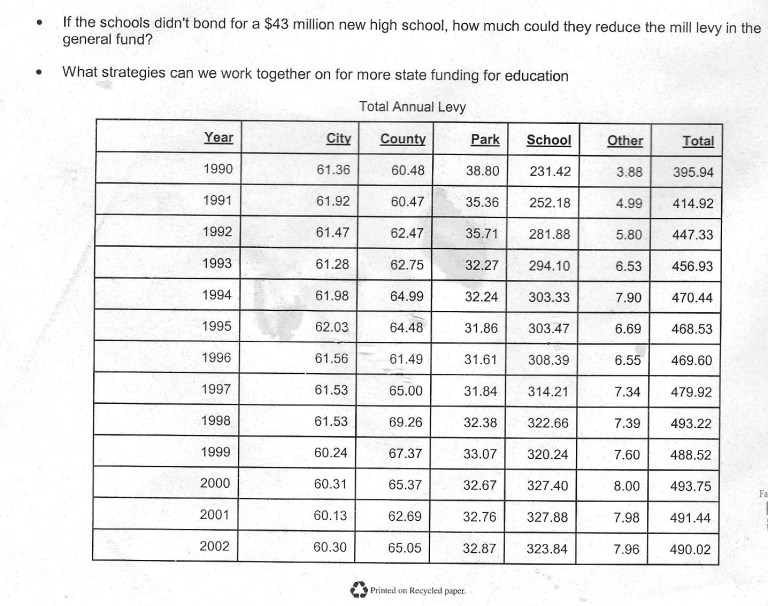

In 1990, my wife, Susan, and I bought our house. We started paying more attention to property taxes and watched Fargo School taxes increase as state funding for education decreased. The Fargo School levy increased over 96 mills in just 10 years from 1990 – 2000.

As I researched this, I started to get engaged to try to help find some positive solutions. I got involved in city issues in 1995 first as a citizen activist. now as a Fargo City Commissioner since 2004.

Due to good work by many, it’s great to see the combined Fargo Schools and City of Fargo property tax rates (Mill levy) have been decreasing at a strong pace since 2005.

Fargo Public Schools is by far the largest portion of our property taxes, but with increased funding from the state, the Fargo School 146.38 mill levy is now less than half of what it was at it’s peak 327.88 mills in 2001.

Fargo’s mill levy has also dropped from a high of 62 mills in 1995 to 48.40 mills today.

Here’s a comparative analysis of some of the cities mill levy’s across the state. Historically Fargo’s range has been between 62 mills and now 48.40 mills, the lowest it’s been. Notice Williston and Dickinson have lower mill levy’s but their economy is less diverse and more dependent on oil activity making it more volatile.

So how does this affect our Fargo property taxes? Most homeowners paid more property taxes in 2005 than we do now, even though valuations have increased with the rising cost of our strong housing market. In my case, even though our house has almost doubled in value (the 2016 assessed value is $140,000), due to lower mill levy’s, we paid $634 less in property taxes this year than we did 10 years ago in 2005.

Enter the Renaissance Zone

There are multiple reasons for the reduction of our tax rates in Fargo, primarily more state funding for education, but another reason is an increasing tax base due to adding value in our city’s core that had been dwindling for years prior to the Renaissance Zone.

The Renaissance Zone was promoted by cities across North Dakota that had similar issues, deteriorating downtown’s and diminishing tax base in central cores. Legislators responded and passed the needed legislation in 1999. The program is for property owners that invest at least 50% more than their current value into improvement to their building. If they meet the standards, owners continue to pay their current property taxes but get a 5 year exemption on the improved additional taxes on the buildings new value.

Here’s how it’s working:

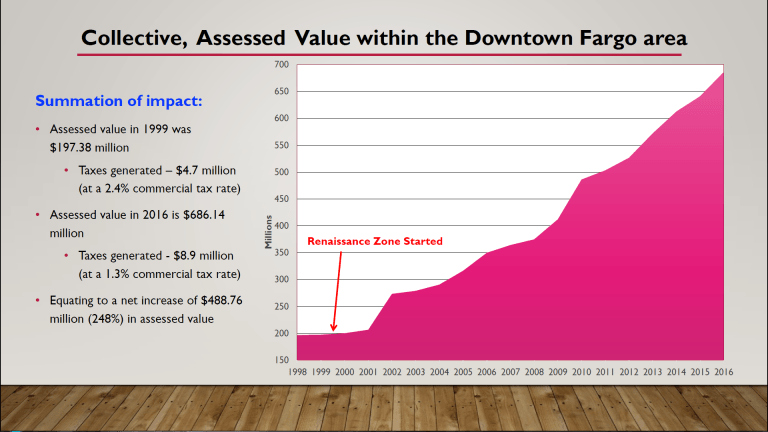

The positive impact of the Renaissance Zone the 5 year targeted incentive program is easy to see on this chart.

The taxes generated are double even with the decrease in tax rate.

The value of the area defined as downtown has almost tripled since Renaissance Zone started in 1999 when downtown had lost many of it’s stores, businesses, and residents.

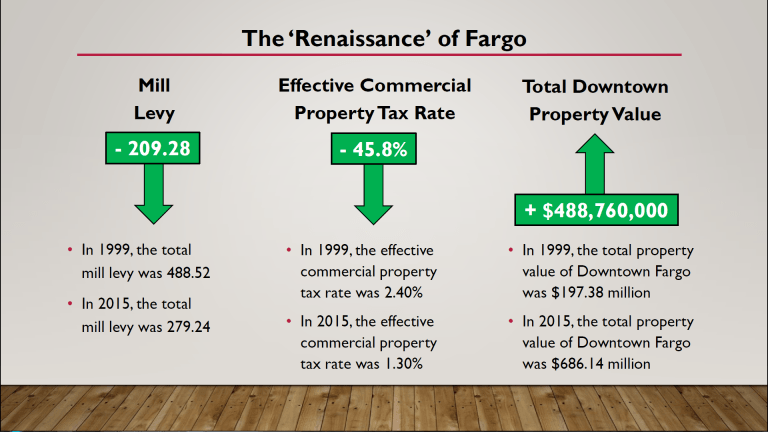

Fargo’s combined mill levy is down, tax rate is down, and total property value in the downtown has increased greatly.

Is the Renaissance complete?

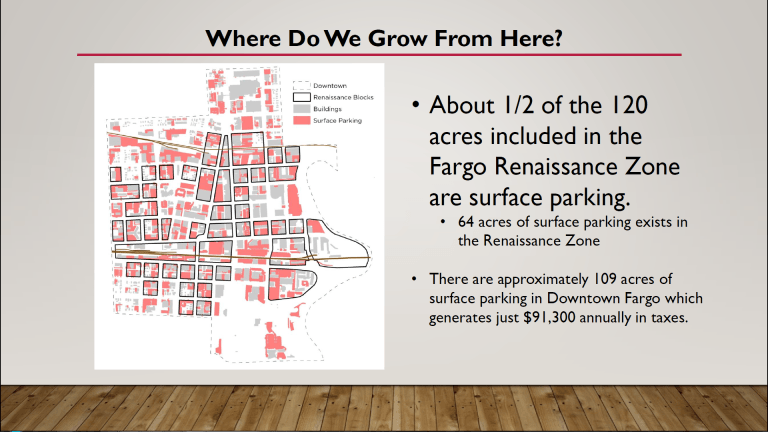

No, there are wonderful opportunities for higher value quality mixed use developments on 64 acres of surface parking that comprises half of the 120 acres in the Renaissance Zone.

The are 109 acres of surface parking lots in the downtown where vibrant mixed use buildings used to be. All of these lots combined pay a grand total of just $91,300 annually in combined property tax. Not much of a tax base.

64 acres of those are in the Renaissance Zone. A majority of the land in the Renaissance zone is now low-value surface parking. Here’s an example of how we can add housing, retail, commercial and parking in these areas. The private/public mixed use development below will be on 2nd Ave and Roberts Street.

The three private lots on this site now pay just $3,379 in annual taxes. Those taxes will continue to be payed during the 5 year Renaissance program. After that time, the new additional taxes are estimated to be approximately $240,000 annually after the 5 year Renaissance exemption on the $20,000,000 private investment.

The private structure will be wrapped around a 450 stall public parking structure that will be paid by parking revenue from renters on city owned property. This more than doubles the available public parking on the site, adds 140 residential units, affordable pop up retail in alley, retail on ground floor, and 6,000 sqf commercial. This private/public development is due to be completed on 2nd Ave and Roberts next year.

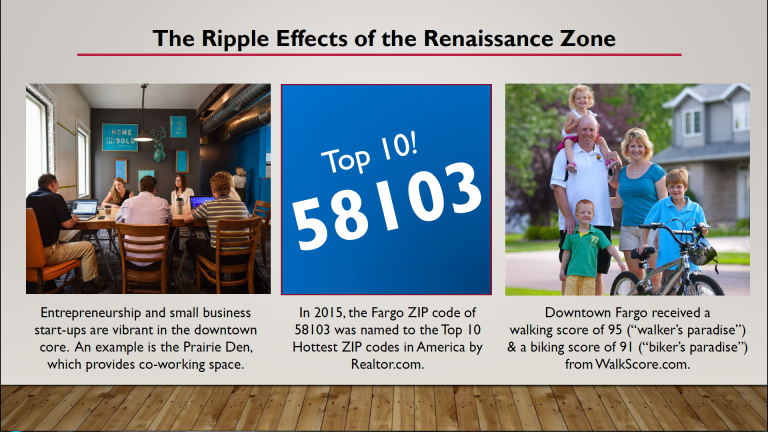

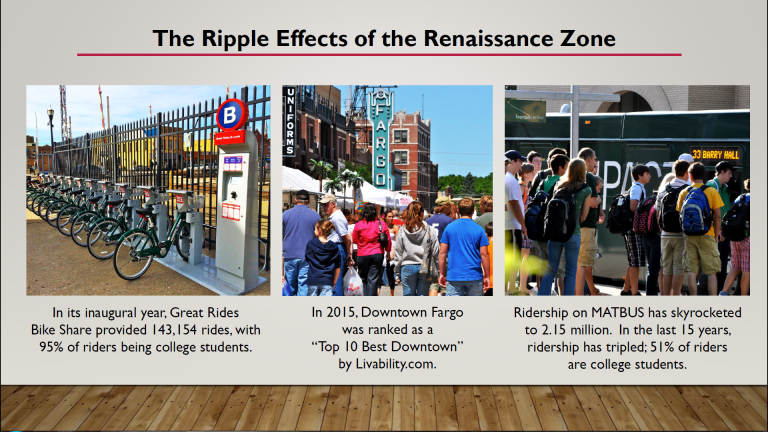

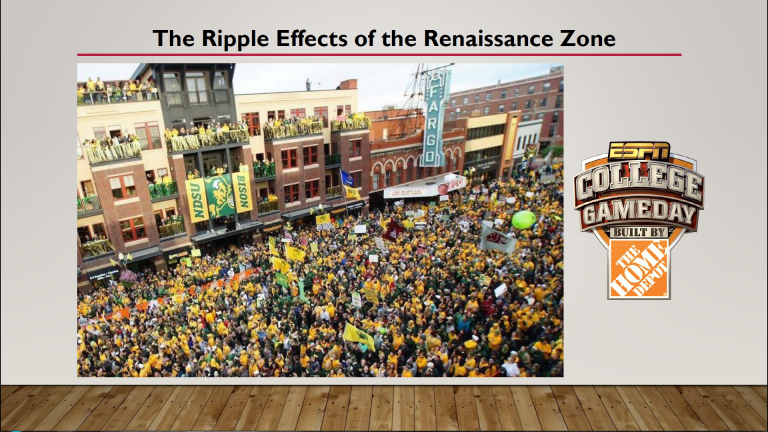

Ripple effects of Renaissance Zone

I wonder if any of these great things would have happened without the Renaissance Zone? Let’s keep working to grow well together, keep what works and improve what we can.

We’ve got a lot of good things going on in Fargo thanks to a strong community with a growing diverse economy and population. Let’s keep what works and improve what doesn’t while we keep working together to be the best city in the country!