The Opportunity Cost of Tax Incentives in Kansas City

Editor’s Note: This article is part of a long-term series exploring the history of Kansas City and the financial ramifications of its development pattern. It is based on a detailed survey of fiscal geography—its sources of tax revenue and its major expenses, its street network and its historical development patterns—conducted by geoanalytics firm Urban3. Here are all the articles in the series:

Kansas City's Fateful Suburban Experiment • Is Kansas City Still Living on Its Streetcar-Era Inheritance? • "Kansas City's Blitz": How Freeway-Building Blew Up Urban Wealth • The Road to Insolvency is Long • Asphalt City: How Parking Ate an American Metropolis •

The Local Case for Reparations • Ready, Fire Aim: Tax Incentives in Kansas City (Part 1) •

The Opportunity Cost of Tax Incentives in Kansas City (Part 2) • The Numbers Don’t Lie •

Kansas City Has Everything It Needs

Over the past four decades, Kansas City has aggressively used tax incentives to induce development, in a manner I described in the first half of this two-part article as “Ready, Fire, Aim,” because seemingly just about any development is fair game for the tool. Despite that tax increment financing (TIF) and tax abatement are meant to be tools for addressing blight, Kansas City has not been picky about where it will apply these incentives (in the city's productive core or its nearly-rural northeastern corner) or in what form (auto-oriented suburban or walkable urban). It has not tied its use of tax incentives to a clear, defined set of public policy goals. And the results have been hit and miss: TIF, for example, has built a popular entertainment district and rehabilitated a historic hotel, but also helped finance a whole lot of parking (a land use that generates very little value) and some short-lived big box retail.

Many of the city's TIF districts are underwater, and some have required bailouts. Some, as demonstrated in the previous article, have produced projects that are literally worth less on the market, finished, than the amount of public financing that went into them. In the words of Mercatus Center economist Matthew Mitchell:

Remember, with enough incentives you can get oranges to grow in Maine. But that doesn’t mean you should.

Some, however, have produced projects that appear to be valuable contributions to Kansas City's landscape and its tax base. Does this mean TIF was worthwhile in those cases? Not necessarily. It depends on the “But For” test.

The reason tax incentives are so seductive to local officials is that they feel like a magical source of "free money" for economic development. TIF sacrifices future revenue for present-day development, funding a project in part out of the extra taxes (the "increment") it would have generated over a prolonged period (in Missouri, this is up to 23 years). The "free money" part lies in the assumption that, but for the tax subsidy, no development would have occurred. And that, therefore, the government is only sacrificing revenue it never would have had anyway.

But how often does that assumption actually hold? It turns out that, in practice, the "but for" test that is so fundamental to the logic of TIF has more holes in it than a honeycomb.

A highly critical study of Kansas City’s TIF deals by Patrick Tuohey of the Show-Me Institute found that in practice, both the “but for” test and the blight finding requirement are meaningless because they are so easily gamed: the authors could not find a single instance in Missouri in which a consultant’s finding on these matters did not come back in support of the TIF.

As applied almost everywhere—not just Kansas City or Missouri—the standard of proof for “but for” is extremely low, and more importantly, it's often misinterpreted to mean "but for the TIF, this specific development in this specific location would not be viable." That's not a good enough test for being worthy of subsidy, because it ignores the question of opportunity cost: that is, what else would happen if we didn’t rush to pull the TIF trigger?

Three Ways "But For" Can Fail

As Dustin Dye of UMKC observes in a review of Kansas City’s experiences with TIF, “but for” is slippery. If any of the following three things are true, then your TIF isn't really passing the "but for" test. It may just be moving economic activity around without clearly generating more of it.

"But for" tax incentives here, the same development would happen elsewhere.

"But for" tax incentives here, different development would happen elsewhere.

"But for" tax incentives here, different development would happen here.

We can observe likely cases of all three of these problems in Kansas City.

1. "But for" incentives here, the same development would happen elsewhere.

The worst thing you can use TIF for is retail, and especially big-box retail. This is because overall consumer spending isn't going to go up—TIF isn’t resulting in your residents having more buying power. More likely, it's just going to shift around. There is only so much retail a region can support. And yet, TIF in Missouri has often been used for retail—and for big boxes even at the expense of the displacement of small businesses—because of an arms-race phenomenon in which cities compete with each other for sales tax revenue.

One of Kansas City’s worst TIF blunders is the site of the former Blue Ridge Mall. One of the earliest malls in the country, it opened in 1958 as an outdoor shopping center and enclosed in the 1970s. It declined during the 1990s, as did so many of that early generation of indoor malls around the country, and by 2001, it had lost its anchor stores of Montgomery Ward and JC Penney and closed its doors.

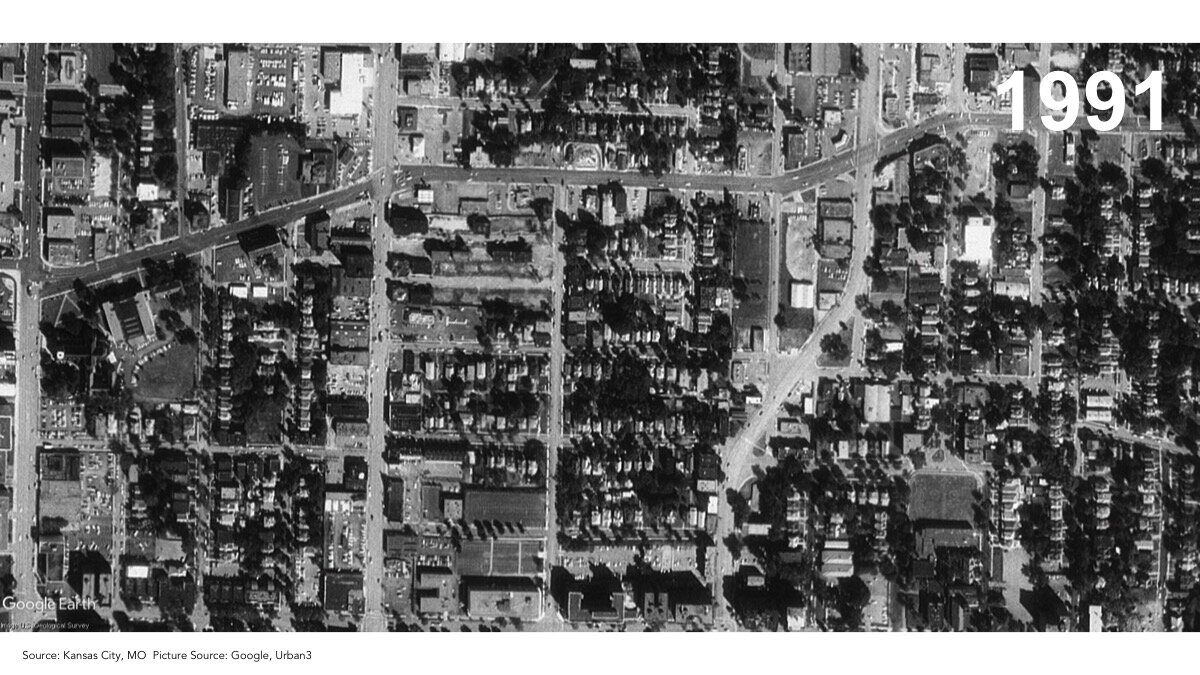

Time lapse of the Blue Ridge Mall site redevelopment.

In 2005, the mall's owners received $27 million in TIF to demolish the blighted mall and build a new shopping development anchored by a Wal-Mart Supercenter. That $27 million leveraged $63 million in private capital, all to increase the value of the property from $2.5 million to *checks notes* roughly $13 million today, and actually reduce the retail square footage. This amounts to a colossal blunder even before you account for the “but for elsewhere” factor: there is no reason to think that TIF in this location increased total retail sales or tax revenue. TIF or no TIF, a retailer as ubiquitous as Wal-Mart presumably would have found a way to sell to Kansas Citians.

One suspects the project was motivated in part by a common sort of sunk cost fallacy: the desire of leaders to remediate a glaring case of suburban blight at any cost, no matter how irrational, rather than walk away from it. The Blue Ridge Mall TIF was controversial at the time, and has only remained so. One school district successfully sued Kansas City for lost revenues from the Blue Ridge Mall TIF, a case that was settled for $3 million in 2016.

2. “But for” incentives here, different development would happen elsewhere.

The KC Live! block of the Power and Light District. Image: Wikimedia Commons

Even in cases where the would-be developer or corporate tenant of a proposed TIF project has no interest in other sites in the same city, it's still possible that the project directly crowds out or displaces other development, resulting in no net gain. The reason is that many economic activities exhibit a substitution effect.

Dining and nightlife are a good example: there's a certain amount of money that local residents are willing to spend while out on the town, over the course of a typical month or year. Increase residents' discretionary income—through higher-paying jobs or overall economic growth—and you may increase that amount. But simply building more dining and nightlife options won't have that effect. My city can have 100 restaurants or 1000, but if my budget allows me to eat out once a week, then the excess choice has minimal effect on my spending.

The Show-Me Institute produced a compelling demonstration of this in 2016 with regard to the Power & Light District, often touted as the award-winning jewel of a revitalized downtown Kansas City. Noting that only half of the projected number of jobs from KC Live!, a one-block cluster of nightlife venues (whose TIF plan estimated $165 million in TIF reimbursable costs) had been created (1,003 out of a target of 2,034), the researchers pulled data on the total number of liquor licenses citywide, as well as liquor cards issued to individual employees who serve alcohol. These total numbers remained flat citywide, suggesting that the KC Live TIF did not create these jobs but merely relocated them from outside the TIF district.

There’s a lot more to be said about the Power & Light District, which has brought substantial new activity and foot traffic to what used to be a sizable dead zone on the edge of downtown. The spillover effects from this nearby—inducing market-rate, unsubsidized development and encouraging more housing, offices, and retail to locate downtown—could be substantial.

But let’s acknowledge that vague handwaving about such spillover effects makes it really easy to overestimate the economic benefit of this type of mega-redevelopment, and underestimate how much of that growth could have been achieved even without it (if more incrementally and in less concentrated fashion) without it. The same goes for entertainment districts everywhere, and notably, for pro sports stadiums. (There is a cottage industry in inflated economic impact projections for stadiums: its One Neat Trick™ is precisely to account for the money that locals will spend at and around the stadium on game days, but completely ignore whether this translates to money they don't spend at other local venues, or substitute activities such as concerts.)

3. “But for” incentives here, different development would happen here.

A more pernicious problem with TIF involves the opportunity cost of pursuing one seductively easy or immediate development strategy for a site, when more patience or discipline might have yielded a very different and better outcome. In Kansas City, this is exemplified by a big-box shopping center in Midtown, at the corner of Linwood Boulevard and Gillham Plaza. The 33-acre site was initially a neighborhood of private homes and small businesses that, by the 1980s, was struggling with crime and drug abuse. The city pursued a classic Urban Renewal strategy, condemning properties and ultimately razing the whole area in 1993, leaving a large patch of weedy ground.

The vacant site was redeveloped with TIF beginning in 2001, and the super-sized block is now home to a Costco and a Home Depot. A 2000 article from The Pitch KC provides a nice history of the site, and features a young Kevin Klinkenberg, Strong Towns member and frequent contributor, objecting to the project at the time. Klinkenberg likened the proposal to “a spaceship landing in the middle of Midtown”—a fundamentally suburban, car-centric land use in the middle of one of Kansas City’s traditional urban neighborhoods developed around early-20th-century streetcars.

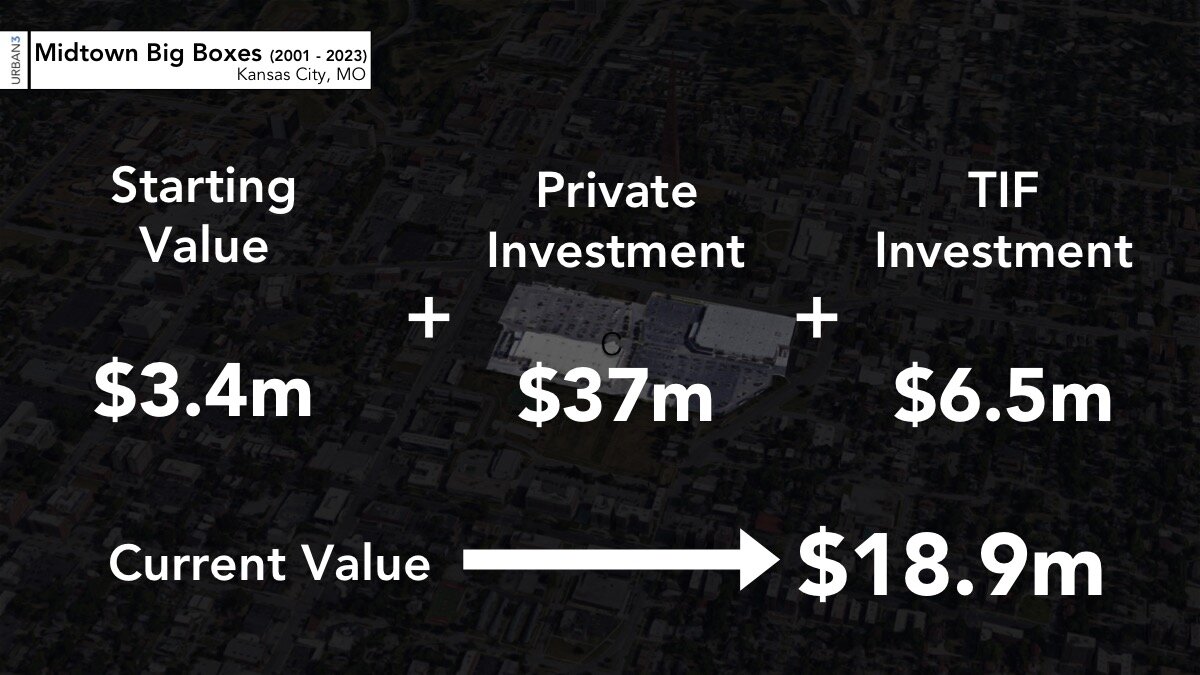

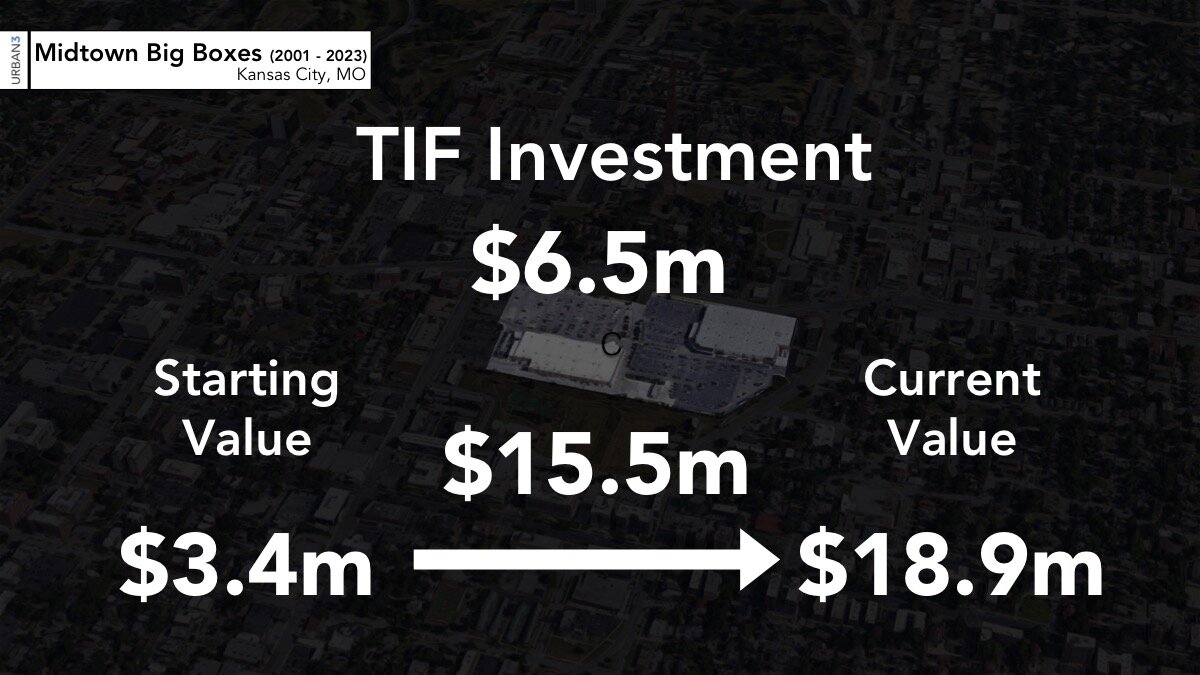

These stores generated a positive economic return in a narrow sense: $6.5 million of public investment to produce $15.5 million of new value, on a prime infill site that had been a barren eyesore. The important question is: compared to what alternative?

What if Kansas City had really invested in revitalizing, instead of demolishing, the neighborhood around this troubled site? Here is a 2018 photo of four historic apartment buildings on Gillham, adjacent to the big-box plaza. Each building (including the Costco and Home Depot) is labeled with its present-day tax value per acre:

We can extrapolate from these buildings to imagine what might be the case if the whole site today were populated by similar development. The answer, if you do simple multiplication, is that it would be worth $40 million—not the $19 million that it is currently valued at as big-box retail. It would also be helping to stitch together, rather than disrupt, the traditional urban fabric of Kansas City’s south side.

But this vision would have required a different kind of foresight and prudence on the part of leaders in the 1990s: the willingness to tackle the problems of a blighted neighborhood with a scalpel, not a sledgehammer, and to accept incremental gains.

Conclusion: Should We Ever Use TIF?

When you look at one project on one site in isolation and ignore everything happening outside the frame, it's extremely easy to justify erroneous conclusions about the value of TIF. When you are hungry for a particular project to succeed, you can fall victim to motivated reasoning. This seems to have befallen Kansas City leaders again and again over the years. Multiple detailed studies suggest that TIF overall has not been a winning proposition for Kansas City, when you take all the "but fors" into account.

This doesn't mean the tool is useless. There are some genuinely good use cases for TIF, and they mainly fall into a couple categories:

One category is cases where there are unusual and costly needs to make any development viable on an urban infill site surrounded by other productive places. Cleaning up contamination is perhaps the best example of this, or demolishing an old building with asbestos problems to allow something to rise in its place. We're talking about cleanup that should happen eventually no matter what.

In Kansas City, TIF was successfully used in 2001 to refurbish the mothballed Hotel Phillips, a historic landmark built in 1931. This is a building worth its weight in gold to the city: it will generate tax revenue well above and beyond its expenses in city infrastructure and services for years to come. The case for preserving the Hotel Phillips, like that of any old landmark building, is that it has proven its staying power: think of it as giving a building a birthday present.

The other good case for TIF is for projects that can serve as a "proof of concept" to convince the private market to invest in an area it's been avoiding altogether. Such a project can overcome neighborhood stigma and perceived risk on the part of private investors, and set off a domino effect of positive transformation. This is the anti-blight purpose.

But in this, we have urged Kansas City to think smaller and more radical at the same time. A true revitalization and reparations policy for its redlined eastern neighborhoods might involve extending the basic toolkit of incentives, free land and tax abatement, not to large outside developers, but to those neighborhoods’ own residents.

There are few absolutes in urban development, and no need for cities to scrap the tax-incentive toolkit completely. But they must recognize the tradeoffs: TIF mortgages your future tax base and possibilities in order to juice growth now, and that is only worth it if there's truly no other way. If "but for" incentives, the future looks like a vacant lot for decades.

It's rare that there's no other way.

In a game-changer for housing and small business development, Washington state eliminated or capped parking mandates statewide. Here’s how they did it.