America's Growth Ponzi Scheme

The North American pattern of development is an unprecedented experiment. For thousands of years, humans around the world built their habitat in similar ways, at similar scales, in patterns still familiar. In the wake of the Great Depression and World War II, settlement patterns across the North American continent were completely reimagined. From the top-down, we transformed everything about how we live, discarding centuries of accumulated wisdom in the metaphorical blink of an eye.

It’s difficult for us to think about the modern American city as a massive experiment because, for most of us, this collection of frontage roads, big box stores, strip malls, cul-de-sacs, franchise restaurants, and single-family homes are all we’ve ever experienced. Yet, take an ancient Roman and drop them into an American city of 1920 and they’d likely be impressed with the grand, yet familiar, setting. Set them loose in a typical American city of 2020 and they’d be completely disoriented.

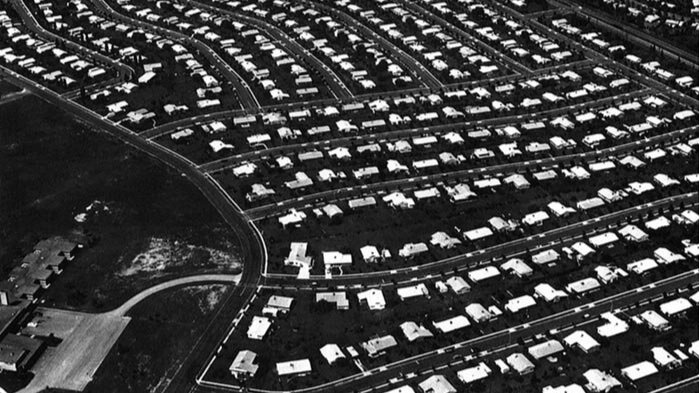

Levittown, Pennsylvania circa 1959

Many would point to the automobile as the reason for transformation, yet other cultures around the world widely use automobiles without such a dramatic shift in arrangement. Instead, the real inspiration of the experimental American approach was financial. We responded to the economic hardships of the 1930s and 40s by radically shifting our development pattern in order to generate growth, create jobs, and quickly build a middle class.

The automobile was one instrument of transformation, but even more important was the federal government’s support for this shift. Programs to promote broad home ownership, investments in infrastructure, and the streamlining of tax and financial structures to achieve macroeconomic efficiency ensured that this experiment was a nationally-coordinated project, one every community participated in.

And it worked. When we measure economic statistics at the national level, the decades immediately after World War II were a golden age. Wages went up while unemployment went down. Economic growth was robust. The middle class began to broaden. While many were left behind or not included in this national project, a lot of Americans still today look back at the prosperity of this time period with nostalgia.

In the decades that followed, we have grown to understand that the underlying financing mechanisms of the suburban era operate like a classic pyramid scheme, with ever-increasing rates of growth necessary to sustain the accumulation of long-term liabilities.

Since the end of World War II, our cities and towns have experienced local economic growth using three primary mechanisms:

Transfer payments between governments, where the federal or state government makes a direct investment in growth at the local level, such as funding a water or sewer system expansion.

Transportation spending, where transportation infrastructure is used to improve access to a site that can then be developed.

Public and private-sector debt, where cities, developers, companies, and individuals take on debt as part of the development process, whether during construction or through the assumption of a mortgage.

In each of these, the local unit of government benefits immediately from all the permit fees, utility charges, and increased tax collection. This is real money that provides revenue for the current budget. Cities also assume the long-term liability for servicing and maintaining all the new infrastructure, a promise that won’t come fully due for decades. This exchange—a near-term cash advantage for a long-term financial obligation—is one element of a Ponzi scheme.

“Over a life cycle, a city frequently receives just a dime or two of revenue for each dollar of liability, a ridiculously low level of financial productivity.”

The other is the realization that the revenue collected over time does not come near to covering the costs of meeting these long-term obligations. Development spread out over a broad area is very expensive to maintain. Over a life cycle, a city frequently receives just a dime or two of revenue for each dollar of liability, a ridiculously low level of financial productivity.

Decades into this experiment, American cities have a ticking time bomb of unfunded liability for infrastructure maintenance. The American Society of Civil Engineers (ASCE) estimates deferred maintenance at multiple trillions of dollars, but that's just for major infrastructure, not the local streets, curbs, walks, and pipes that directly serve our homes. Every mature city has a backlog of deferred maintenance, a growing list of promises with no discernible path to make good on them.

We have responded to this challenge in two ways that compound the tragedy. First, like with any pyramid-shaped financial structure, cities tried to overcome insolvency by growing faster. This alleviates the immediate budget pain but only increases the future hardship. Sequential bubbles over the past four decades in residential and commercial real estate attest to the collateral damage of trying to grow our way out of this problem using the same experimental pattern of building.

The other response has been to increasingly rely on debt to close budget gaps and induce growth. Beginning in the 1970s, corresponding with the transition to the second generation of this experiment, Americans financed new growth by borrowing staggering sums of money, both in the public and private sectors. By the time we crossed into the third generation and flamed out in the foreclosure crisis, our financing mechanisms had, out of necessity, become exotic, even predatory.

We have misdiagnosed the problem. Our problem was not, and is not, a lack of economic growth. Our core problem is 70 years of unproductive growth, a pattern of building and assembling America that has buried our local communities in financial liabilities. We are now forced to grow faster and faster lest it all fall apart. That’s economic growth as desperation, not as a credible strategy for success.

The American pattern of development creates the illusion of wealth. Today we are in the process of seeing that illusion destroyed, and with it the prosperity we have come to take for granted. The signs of decline are now too obvious and too widespread to ignore or dismiss.

Something is broken and we all know it. The pervasive fragility this experiment has created in American society has brought about a level of instability that is combustible. Cities are on the front lines dealing with this hardship. They desperately need a new model for prosperity, one that responds to the urgent needs of people within their communities.

The Strong Towns approach is that model for prosperity.

I originally wrote The Growth Ponzi Scheme over a decade ago in the very early days of the Strong Towns movement. Since then, we’ve been able to share this message with millions of people around the world. This is, by far, our most accessed and cited article.

It’s empowering to clearly recognize the underlying causes of our distress, to know that none of us are alone in this struggle. You’re not wrong to believe that the attempts at scapegoating or the mindless calls for more spending on growth are merely distractions from the work that needs to be done.

With the Strong Towns approach, every city in America has the resources and capacity to become stronger and more prosperous. Every. Single. One.

For years now, we’ve watched people respond to our message. In this unprecedented period of change, we’re grateful we can build this movement with you and help our communities achieve the stable and prosperous future we all deserve.

Cover image via Abraham Barrera.

Charles Marohn (known as “Chuck” to friends and colleagues) is the founder and president of Strong Towns and the bestselling author of “Escaping the Housing Trap: The Strong Towns Response to the Housing Crisis.” With decades of experience as a land use planner and civil engineer, Marohn is on a mission to help cities and towns become stronger and more prosperous. He spreads the Strong Towns message through in-person presentations, the Strong Towns Podcast, and his books and articles. In recognition of his efforts and impact, Planetizen named him one of the 15 Most Influential Urbanists of all time in 2017 and 2023.