The NIMBYs Made $6.9 Trillion Last Year

This article was originally published on longtime Strong Towns contributor Joe Cortright’s blog, City Observatory. It is shared here with permission. All images for this piece were provided by the author.

Housing affordability melodrama: Where’s Snidely? (Source: Wikimedia Commons, with edits.)

So much of our housing debate is a search for suitable villains on which to blame a lack of affordability. Our problems must be due to rapacious developers, greedy landlords, absentee speculator owners, buying new housing and holding of the market, and private companies buying up and renting out single family homes. These are the cartoon characters who get blamed for driving up prices. But they aren’t the ones to blame, and they’re not the ones who are making a killing in the housing market.

The real estate speculators reaping literally trillions of dollars of gains from our capitalist housing system are millions of homeowners, who, whether they acknowledge it or not, are the beneficiaries of “not in my back yard” (NIMBY) policies that have driven up the price of housing. And this surge of homeowner wealth is a rotten development from the standpoint of addressing yawning disparities by race, income and generation, as the beneficiaries of these gains are statistically higher income, whiter, and older than the overall U.S. population.

Last year, according to calculations from Zillow, the value of existing residential real estate in the U.S. grew by $6.9 trillion. (New residential buildings—the construction and upgrading of homes and apartments—contributed about $800 billion.) The gain in home values in 2021 was nearly triple the $2 trillion or or so increase in residential values Zillow reported in 2022. In the post-pandemic era, we’re getting a bit inured to counting “trillions.” To put the amount of housing capital gains in perspective, the $6.9-trillion-dollar, one-year increase in home values is more than ten times the total pre-tax income of the bottom twenty percent of U.S. households (about $600 billion in 2018, according to the Congressional Budget Office).

Here’s another picture of how much housing wealth has been created. The Federal Reserve tracks “homeowner’s equity”—the net amount of wealth that homeowners have after subtracting outstanding mortgage debt from home values. After the collapse of the housing bubble, owner’s equity stood at about $10 trillion, and since then has ballooned to $26 trillion.

To get an idea of exactly who reaped those gains, we took a look at data compiled by the Federal Reserve Board on the demographics of homeownership. The Fed’s triennial Survey of Consumer Finance provides estimates by age, race, and income of homeownership rates and the average value of housing for the nation’s households. Using these data, we computed the number of households by race and age of the household head (which the Fed Survey tactfully calls “the reference person”) and by the income of the household. We’ve combined the value of owner-occupied residential property with other residential property owned by households (i.e., second homes, investment houses, or apartments). The Fed’s estimates (based on its household survey) are somewhat different from Zillow’s (derived from its database of homes), but both put total value of U.S. residential real estate in the $30–$40 trillion range. To a first approximation, these data on the age, race, and income of homeowners are our best guide to who reaped the $6 trillion in residential capital gains this year. That assumption masks some variability in housing price appreciation across markets and classes of homes, but this should be a good rough indicator of the demographics of the nation’s housing wealth winners.

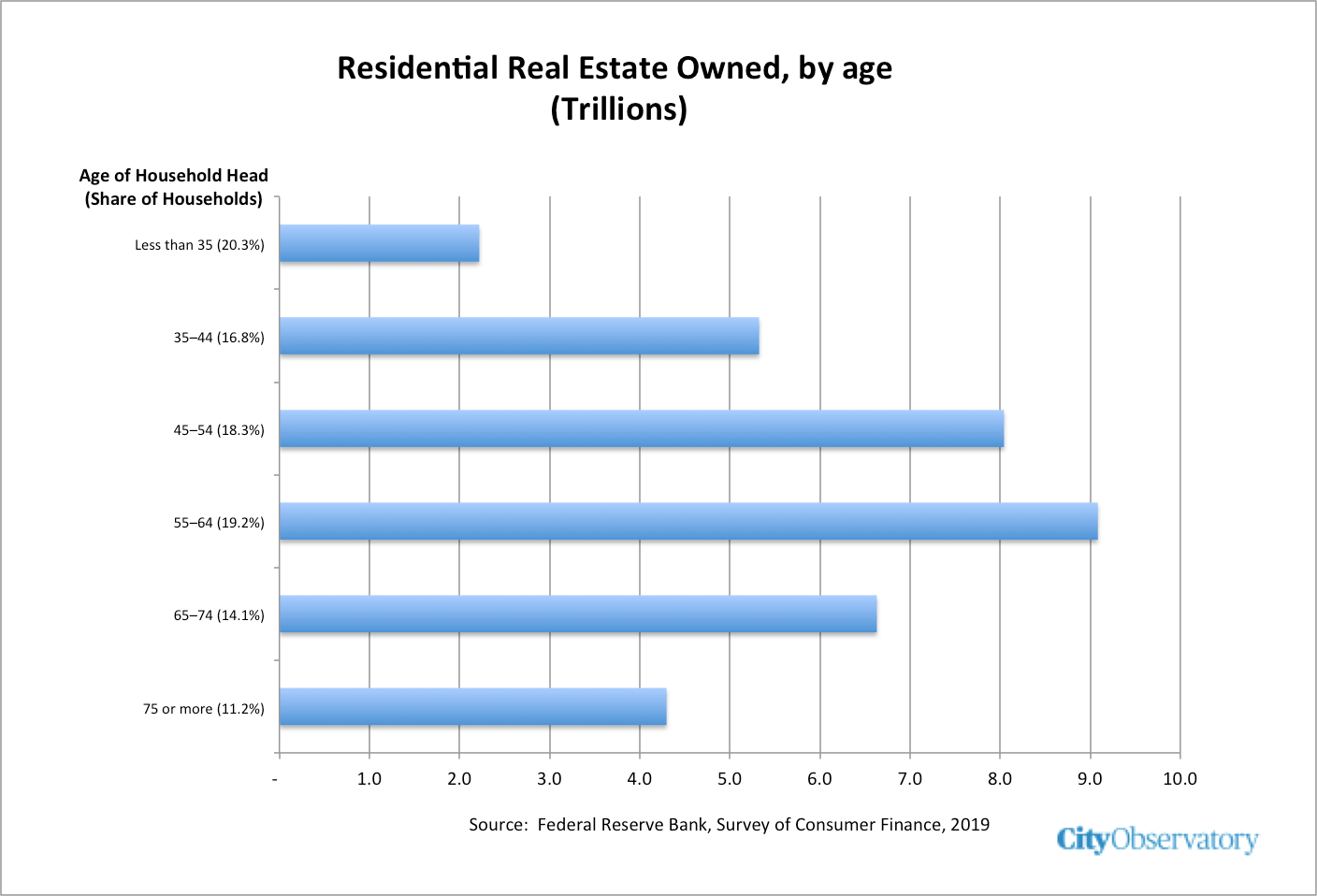

The Gerontopoly of Housing Wealth

As City Observatory has noted before, older Americans hold most U.S. housing wealth, and have been chalking up a disproportionate share of gains as housing has appreciated. The latest data from the Federal Reserve show that households headed by a person aged 55 and older own 56 percent of all residential housing wealth in the U.S. It’s a fair guess that these older homeowners reaped most of the gain in home values in the past year.

As Ed Glaeser has pointed out, rising real housing costs are a straightforward transfer of wealth from younger generations (who must buy the now more expensive homes) to older generations (who own the housing, and will reap gains when it is sold).

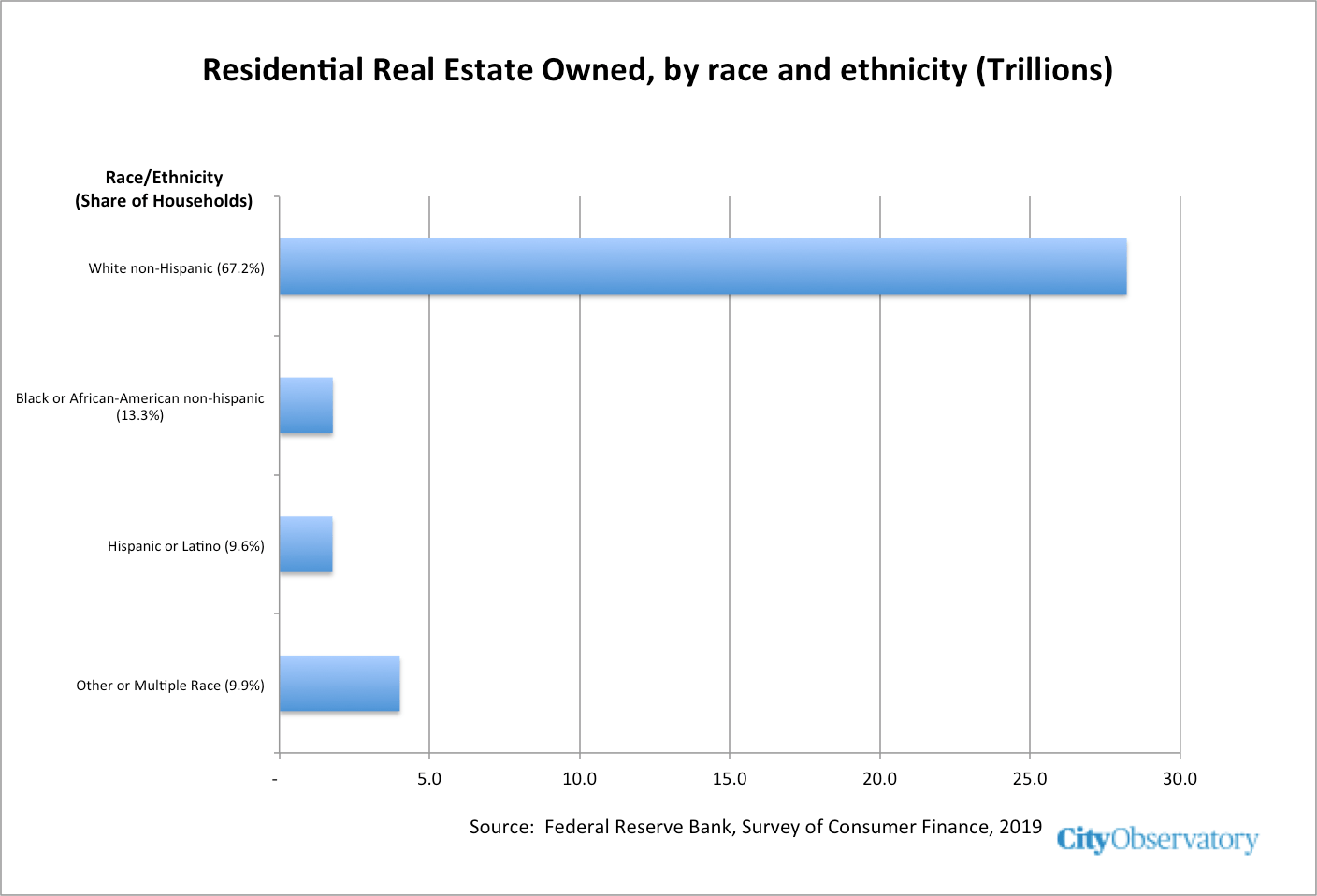

The Long Shadow of Race

For a long list of reasons—including discrimination in housing and labor markets, redlining, and segregation—households of color have been systematically denied the opportunities to accumulate housing wealth. That pattern is still very much in evidence in the latest Fed data: Non-Hispanic white households own almost 80 percent of all the housing wealth in the U.S., implying they also reaped 80 percent of the residential capital gains, or about $1.6 billion.

Rising home prices effectively increase the wealth of white households relative to households of color.

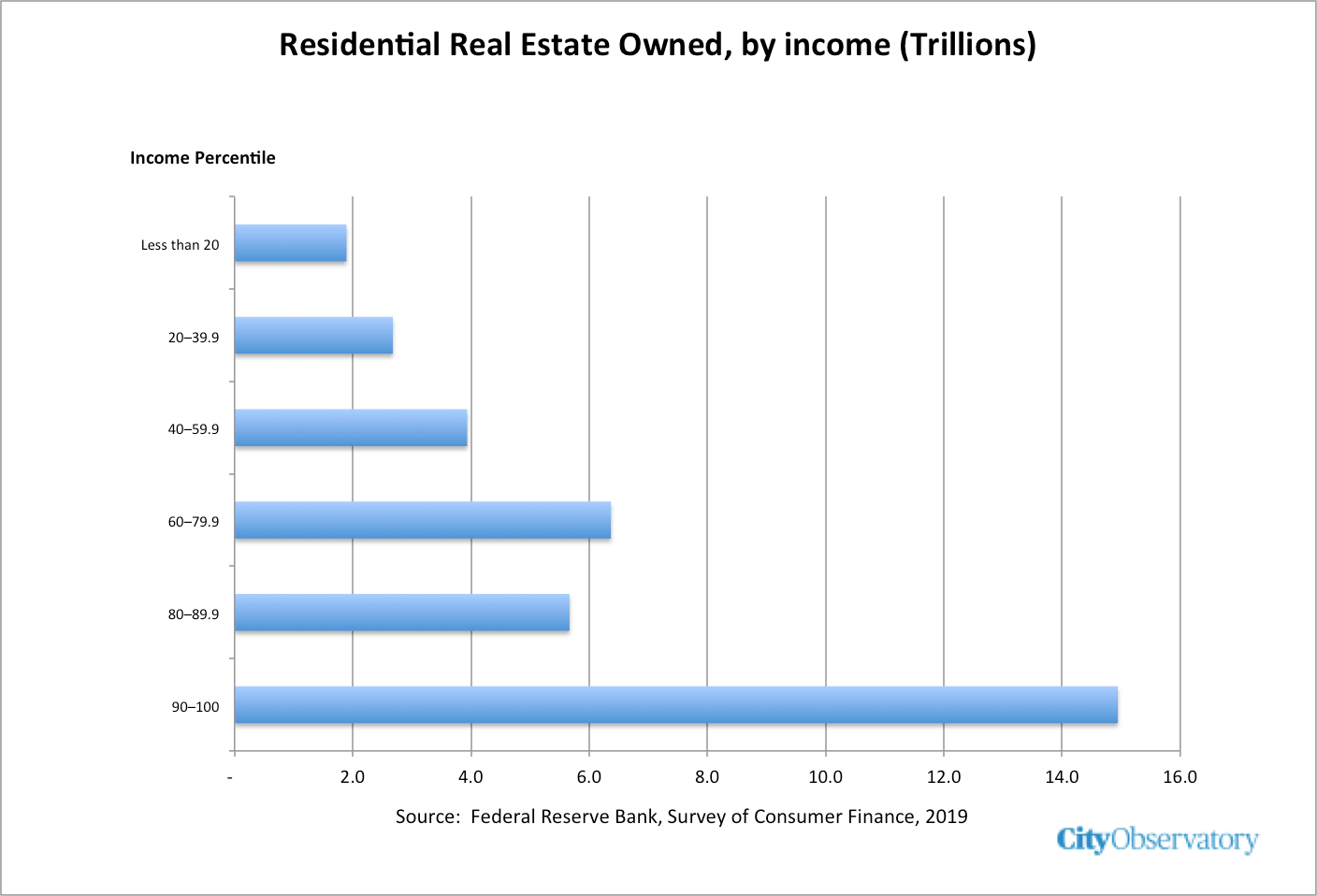

High-Income Households Own Most Housing

While homeownership is touted as a means of wealth accumulation, it has mostly worked out for high-income households. While the ownership of real estate is not as skewed to high-income households as is the ownership of financial assets like stocks or bonds, it is still the case that the highest income 20 percent of the population owns 59 percent of all the residential housing value in the U.S.

These data suggest that about $1.2 trillion of the gain in home values went to the top 20 percent of the population, meaning that their residential capital gains exceeded by a factor of about two the total pre-tax income of the bottom 20 percent of the population.

Housing Appreciation Is Untaxed, Which Benefits Older, Whiter, and Wealthier Households

The skewed ownership of housing wealth means that the gains in wealth are highly concentrated in households that are older, whiter, and higher income than other Americans. But unlike wage income, income from housing appreciation is mostly un-taxed. As a result, the capital gains exclusion for housing is regressive and inequitable. The capital gains exclusion for owner-occupied real estate, is much more valuable to high income households because they are more likely to own homes, own more expensive homes, and generally face higher tax rates that low-income households.

In reality, the $2.2 trillion in capital gains that U.S. residential property owners reaped in 2020 will be lightly taxed, to the extent they are taxed at all. Federal law exempts from capital gains the first $500,000 in gains on the sale of owner-occupied property (for married couples filing jointly). That is to say that you would need $500,000 of appreciation to have any capital gains liability. As a practical matter, few households pay capital gains taxes on residential real estate appreciation. The tax-favored status of income from residential real-estate speculation is a quintessential feature of our system that attempts to promote wealth-building through home ownership. While well intended, it systematically rewards older, whiter, and wealthier households, and effectively denies opportunities to build wealth to the third of the population that is renters. In many ways, it is the worst of all worlds, making housing more expensive for those least able to afford it, and providing most of the gains to those who are already most advantaged.

There’s one final irony here: policies to broaden access to homeownership now, by providing subsidies or other support for lower income, younger, and minority homebuyers don’t rectify these gaps, they likely make them worse. Steps to amplify demand in a surging market tend to drive prices up further, which further enriches incumbent homeowners at the expense of first-time buyers. If you could enable people to somehow buy houses at 1990 or 2010 prices, they could be assured of wealth gains, but the risk is that buying now offers no such expectation of long term gains. Promoting homeownership primarily helps those who are selling homes, not those who are buying them.

The Search for Villains

Rather than talk about the capital gains that flow to older, wealthier, whiter households, much of the housing debate is a melodrama, looking to cast suitably evil villains on which to blame the crisis. It’s fashionable to finger Wall Street investors (who for the past decade or so have been buying up single-family homes and renting them in many U.S. markets); foreign buyers of luxury condominiums in New York, Miami, Seattle and other hot cities (who let the units sit vacant while speculating on higher values); and greedy developers who make excessive profits by building new homes. None of these supposed villains account for more than a trivial part of the problem—at most, they’re picking up crumbs, compared to the the trillion dollar gains logged by incumbent homeowners.

A recent article in The New York Times suggests Wall Street-backed investors now own as much as $60 billion in single-family real estate. That sounds ominous, but it’s less than 1 percent of the $35 trillion or so of residential investment in the U.S. If all these investors earned a 10 percent capital gain in 2020, they would have collectively gotten about $6 billion, or a couple of tenths, of one percent of the $2.2 trillion in home values. It’s also fashionable to blame the construction of luxury condos in a few superstar cities—held vacant by rich, often foreign speculators. The trouble is that such units are a tiny slice of the housing market, and there’s no evidence they affect overall housing costs.

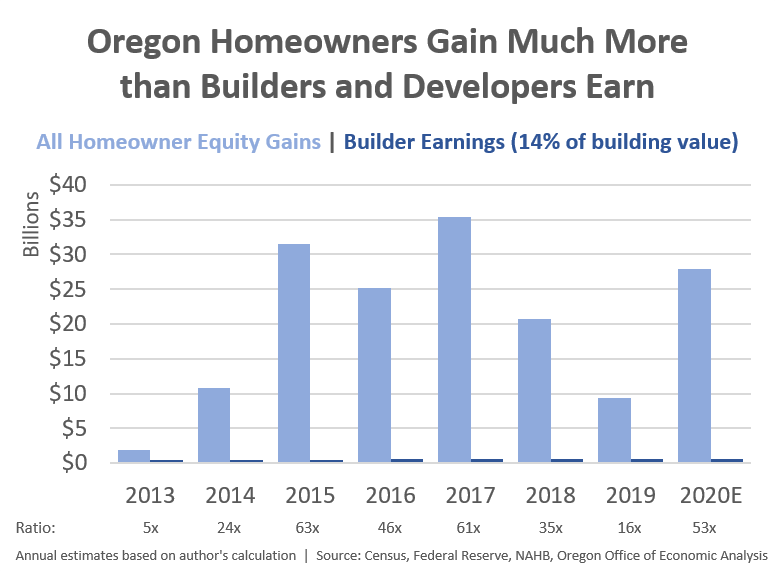

And then there are the developers. Supposedly they make a killing from building new housing. When housing price are appreciating, especially as fast as they have in the past year, the profits that developers earn from building new housing are dwarfed by the capital gains reaped by existing homeowners. City Observatory’s friend Josh Lehner, an economist with the Oregon Office of Economic Analysis, has an insightful study estimating the profits earned by homeowners and developers in Oregon over the past decade. Lehner estimates, that on average, developers reap a margin of about 14 percent on new housing construction. By comparing that total (14 percent of the value of new housing built in any year), with the appreciation of the existing housing stock in that same year, Lehner is able to show how developers profits stack up against the capital gains enjoyed by incumbent homeowners. It isn’t even close:

Applied to Zillow’s estimates of national level new construction, Lehner’s 14 percent of building value estimate suggests that developers netted less than $40 billion nationally, an amount equal to about 2 percent of the gains that accrued to owners of existing homes. It’s not the greedy developer that’s benefiting from rising home prices, it’s the NIMBYs next door who reap the gains. As our colleague Daniel Kay Hertz has pointed out, we tend to conveniently forget that essentially all of the existing housing stock came into being, not by immaculate conception, but by the profit-motivated efforts of earlier generations of developers. If anything, because new development increases housing supply, it blunts housing price appreciation, so more development tends to increase affordability.

Wall Street investors, speculating oligarchs, and greedy developers all make signature villains in the housing affordability melodrama, but they really conceal the identity of those who are actually reaping the gains of rising housing prices. It also hides the principal policy that’s driven the appreciation of residential real estate: the dominance of a range of NIMBY policies, including excessive single-family zoning, apartment bans, high development fees, parking requirements, and a host of other policies that have made it harder to build housing, especially in the places people most want to live.

The experience of the past year illustrates the profoundly broken nature our current strategy of “wealth-building through home ownership.” The benefits of home price appreciation accrue disproportionately to those who already have wealth, and if anything, they tend to worsen the existing disparities of wealth among households. As existing housing appreciates, it increases the wealth of the incumbent homeowners, who are disproportionately white, older, and wealthier, and drives up housing costs for those who don’t now own homes. And our tax system amplifies these inequities by allowing nearly all of this income to go untaxed. The myth of homeownership as a universal wealth-building strategy is the real villain here.

A version of this commentary was originally published in 2021, and has been updated to reflect the latest data on home price appreciate estimated by Zillow.

Joe Cortright is President and principal economist of Impresa, a consulting firm specializing in regional economic analysis, innovation and industry clusters. Over the past two decades he has specialized in urban economies, developing the City Vitals framework with CEOs for Cities, and developing the city dividends concept.

Joe’s work casts a light on the role of knowledge-based industries in shaping regional economies. Prior to starting Impresa, Joe served for 12 years as the Executive Officer of the Oregon Legislature’s Trade and Economic Development Committee. When he’s not crunching data on cities, you’ll usually find him playing petanque, the French cousin of bocce.

What if, rather than having to move because of life changes, your house itself could change? We present to you THE architectural solution to this common problem: The Incredible Expanding and Shrinking House.